Low oil prices naturally cause problems for producers – at least in the short term. The real question is whether it prompts them to adjust their economies so that they become less reliant on hydrocarbon revenues.

In practice, there are very few genuine rentier states that are almost wholly dependent on their oil and gas revenues. The smaller Gulf states are the most obvious example, as are Brunei and Libya. But although oil accounts for the biggest single chunk of government income in countries such as Russia, Iran and Mexico, their actual economies are already far more diversified so therefore, while government spending is severely impacted, ordinary standards of living and general economic well-being are potentially less affected.

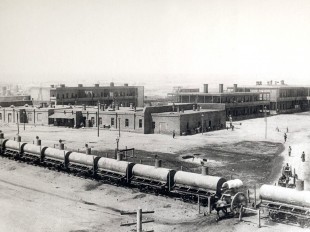

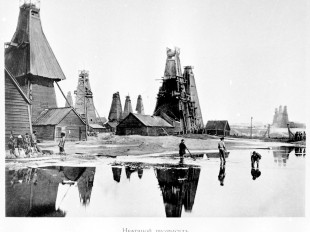

The development of Azerbaijan’s non-oil sector in the last 25 years, which includes its transformation from a Soviet-style semi-industrialised society to a more broad-based economy, should help Azerbaijan in the medium- to long-term as it strives to surmount any immediate crisis caused by the current squeeze on oil income.

Moreover, there is the role played by the banking of previous revenues into sovereign wealth funds. The most extreme example of this was provided by Kuwait when, in effect, the Kuwaiti government in exile during the Iraqi occupation of 1990-91 used the country’s financial reserves over which they still retained control, to finance a large part of the war that liberated Kuwait in the spring of 1991. Today, the best example of a government that has consistently looked to the future with regard to its energy revenues is, of course, Norway, which has reached the stage where its role as a provider of oil and gas for the world is enormously more important than the role of oil and gas in providing financial security for Norway itself. Indeed, in 2015 revenues from its oil fund exceeded revenues from actual oil production.

In this context, Azerbaijan has its own accumulation of funds generated by previous oil and gas exports. The State Oil Fund of the Republic of Azerbaijan holds more than $30bn in assets (as of 1 January 2016, these totalled $33.6bn) and these funds can now be utilised. But there is a fine balance that has yet to be determined between the funds released essentially to cushion the blow for wages and subsidies and the amount made available to strengthen Azerbaijan’s non-oil GDP.

In terms of reacting to the onset of a potentially prolonged era of low oil prices, several examples can be profitably studied. The first is Iran, if only because it was regarded as a particular target when Saudi Arabia switched from a policy focussed on upholding prices to one based on protecting market share. The second is the United States, notably the impact of low prices on its development of unconventional oil and gas, particularly from shale deposits. The third is Saudi Arabia, which has announced it is embarking on a radical change in the handling of both its economy and projected government finances. The fourth is Venezuela, which remains extremely significant precisely because of the extreme reluctance of the government to adjust its policies in any practical way to deal with the underlying financial issues stemming from the onset of relatively low oil prices. The fifth is Russia, whose government remains overly reliant on energy revenues.

A final, more general, element concerns the way in which consumer countries are continuing to accelerate their use of renewables, despite the prospective abundance of relatively cheap oil and gas on global markets.

Iran

When Saudi Arabia challenged conventional thinking at the OPEC meeting on 27 November 2014, by declining to take part in a proposed OPEC-wide production cut there was a common assumption that the Kingdom was assuming that any fall in prices resulting from its inaction would damage Iranian production prospects and cause significant problems for US shale oil production. Since then, the Saudis have persisted in their policy of placing market share above prices as a priority in their oil policy. But the US and Iran have come through this challenge in a much better state than might have been expected.

For Iran, the implementation of the Joint Comprehensive Plan of Action agreed in July 2015 in order to end the country’s stand-off with much of the rest of the world over its nuclear programme has been far more important than the fall in prices. It has prioritised oil production and exports and has managed to ensure that its overall income has not suffered. There may be some significant medium-term consequences in that prioritising oil has almost certainly led to the deferral of some potential gas export options, but, in the long run, the Iranian energy economy has emerged much stronger than expected, despite the deterioration in oil prices.

The US

The Iranian response was quite clearly a determined government effort. But the US response, which was market-driven, was no less impressive. Because the investment cycle for shale oil is relatively short, and can generally be measured in months rather than years, there had been an expectation that investment levels would fall off quickly and that there would be a comparable falling off in actual production within a year of the OPEC meeting. Although there was an initial slump in shale oil production, what was striking was how quickly US shale oil production recovered as it adapted to changing conditions. In essence, the companies producing shale oil rapidly learnt how to cut costs so that their cutbacks were much smaller than initially expected. Moreover, the US government no longer seemed nearly as worried about this state of affairs as perhaps the governments of some other oil producing countries had expected. The US remains a net importer of oil – in 2015 it consumed 19,396,000 b/d but produced only 12,704,000 b/d – and thus started to gain a significant economic boost to its overall economy from the fall in oil prices. This even applied to Texas itself where falling production and local oil industry concerns were eclipsed by a consumer boom that saw most Texans happy that gasoline prices were down, rather than worried that oil sector jobs were at risk.

Saudi Arabia

For Saudi Arabia itself, the impact has been staggering. It has responded with what is clearly intended to be a root and branch overhaul of the country’s financial arrangements. The changes envisaged in its Vision 2030 programme are so extensive that it remains improbable that they will all be achieved. But by taking a highly coordinated approach, in which royal, governmental and state corporate power are all harnessed to work in unison, the Kingdom has greatly increased its prospects of achieving a radical transformation which would significantly reduce the government’s reliance on oil revenues. The importance of strong personalities in driving this approach cannot be underestimated. Deputy Crown Prince Mohammed bin Salman, sometimes described as King Salman’s favourite son, provides the core political underpinning for this approach while Oil Minister Khalid al-Falih provides much of the intellectual and practical administrative rigour and Saudi Aramco President Amin Nasser much of the expertise when it comes to actual delivery. This trio has clearly come to the conclusion that Saudi Arabia must embark on wholesale reform, even if they cannot deliver all the elements envisaged in the reform package.

The programme involves the wholesale dismissal of government employees, the introduction of a wide range of taxes and utility charges and embraces a determination to float part of the giant Saudi Aramco oil company. Whether it succeeds will depend on political as well as economic factors. The amount of pain that could be inflicted on Saudi nationals who are dependent on the government or state operated companies for their income is massive. And how they will take this pain is far from clear. However, Saudi Arabia does have some safety valves, notably its own accumulation of reserve funds built up when oil prices were high, and also the vast accumulation of wealth in Saudi hands banked abroad over the last half century which will enable key families to ensure that both themselves and their dependents, which include their employees, can continue to secure at least minimum incomes at a time of government financial constraint.

Venezuela

This is a country that used its oil wealth not to develop financial reserves or sovereign wealth funds, but to secure political capital with a host of countries, most notably with China and with its key Caribbean neighbour, Cuba. Internally, but for both political and economic reasons, it is a country that appears to be on the verge of collapse. It suffers both from an inability to pay salaries on time, to ensure food in the shops, and to cope with a crisis caused by its rejection of opposition demands that winning a parliamentary majority in a general election should mean a change of government.

It may be that the Venezuelan government of President Madura is looking for China and Cuba to help bail it out: the one with money and the other with troops. It is probably misjudging that situation and in all probability Venezuela will provide proof that an oil producing country can only survive a prolonged period of low oil prices if it is prepared to reform its economy radically.

Venezuelan president Nicolas Maduro speaks at the 23rd World Energy Congress opening ceremony on 10 October 2016 in Istanbul, Turkey Photo: Prometheus72/Shutterstock.com

Venezuelan president Nicolas Maduro speaks at the 23rd World Energy Congress opening ceremony on 10 October 2016 in Istanbul, Turkey Photo: Prometheus72/Shutterstock.com

Russia

The last case is Russia. The Russian Government may not be quite as reliant on energy revenues as it appears at first sight, but the fall in income from oil and gas means that there is less cash available for discretionary spending. According to official statistics, oil and gas revenues accounted for 51.3% of the federal budget revenues in 2014 but for 43% of 2015 budget revenues and for just 37.4% of projected 2016 revenues. There is an argument that these figures may be somewhat inflated as the federal budget does not include all government spending, with regional budgets, for example, calculated separately. But the bottom line is that the federal government in Moscow remains perilously dependent on its energy revenues with a 6% cut in planned budget expenditures in 2016 as lower prices took their toll.

In theory, Russian state enterprises are operating under federal instructions from December 2013 that they must cut their investment budgets by 10% a year over a five-year period. In practice, however, there is little sign of any such cutback as oil production climbs to record levels and as gas output starts to regain some of the ground lost in European markets in recent years. But while this has limited the immediate impact on revenues, with additional oil exports in particular helping to cover some of the losses sustained from lower prices, it has also contributed to the maintenance of generally low prices (at least by comparison with pre-2014 highs).

Whether Russia will mount a major effort to reform both its economy and its financial structures remains uncertain. This is a course that is publicly advocated by the Kremlin insider Alexei Kudrin, who was finance minister from 2000 to 2011.

What the Russian government needs to do is diversify the economy … make revenues more dependable and less dependent on oil, Kudrin has said.

We are too dependent on oil and this is what stops our currency from being stable and makes it too volatile … as the price of oil dropped so did the Russian rouble, he told the St. Petersburg International Economic Forum in June, a meeting also addressed by President Vladimir Putin.

This does at least indicate that Russia is aware of the problem, but it is not yet clear whether it is actually going to tackle the problem seriously or whether it is simply hoping that energy prices will recover and the crisis will blow over.

Changes in global consumption patterns

In considering how these countries have reacted, and what lessons might be learned from these reactions, Azerbaijan also has to take into account the changing nature of global energy. In 2015, for the first time ever, a combination of nuclear power, hydropower, wind power and solar accounted for all the increase in global energy consumption. And in 2016, all of the increase in global power consumption is expected to come from just wind and solar. The actual figures are tiny. In 2015, the world consumed a total of 13,147.3 million tonnes of oil equivalent (mtoe) of energy from all sources, a mere 127 mtoe above output in 2014. And in 2016 a similar pattern is likely to be observed. But it is the fact that it is investment in renewables that is driving the change, not investment in traditional oil and gas. This means that hydrocarbons producers will have to fight ever more strongly to secure a stake in markets that may still be growing, but slower than before, and which are being outpaced by investments in renewables.

What does this mean for Azerbaijan? With Azerbaijan focussed on maintaining oil production at Azeri-Chirag-Guneshli and implementing the massive Shah Deniz Phase II Gas Expansion project, the challenge of renewables remains more distant. But it is there and it may well impact on investment plans for further Caspian field development in the 2020s, notably in gas, but also in oil.

Moreover, there is no clarity concerning the future course of oil prices. On the one hand the victory of Donald Trump in the US Presidential election of 8 November provides a fillip for US oil producers in that he is likely to favour their interests, not least by approving the controversial 1,897-km Keystone XL pipeline from Canada to Nebraska (projected to cost around $8bn) and the 1,866-km, $3.7bn Dakota Access Pipeline from North Dakota to Illinois.

These projects, one rejected by the Obama Administration outright and the other delayed when Obama’s Justice Department suggested alternative routing, would serve to cut the distribution costs of output from Canada’s oil sands and shale oil from the giant Bakken deposit in North Dakota, Montana and the Canadian provinces of Manitoba and Saskatchewan. Trump might also help by easing some of the environmental obligations of energy companies. Yet at the same time, such moves would serve to drive down oil prices, making conditions tougher for producers elsewhere.

US President-elect Donald Trump speaks to supporters during the election campaign at a rally in Atlanta, Georgia, on 21 February 2016 Photo: Action Sports Photography/Shutterstock.com

US President-elect Donald Trump speaks to supporters during the election campaign at a rally in Atlanta, Georgia, on 21 February 2016 Photo: Action Sports Photography/Shutterstock.com

On the other hand, there are concerns that, as an untested leader in terms of any government or foreign policy role, Trump might wittingly or unwittingly trigger some kind of international crisis that would drive prices up rapidly. He is not likely to try to turn into reality his campaign cry that America should think about seizing the oilfields of Iraq to pay for the cost of US military operations in the Middle East, but the very fact of such slogans will make many government leaders around the world somewhat wary.

So Azerbaijan will have to prepare itself for a period of considerable uncertainty. And at a time of uncertainty, this means that it has to prepare for the worst whilst hoping for the best. In practice, this means an assumption that oil prices of around $50 a barrel are here for the foreseeable future and that it will have to adjust government finances accordingly, and that it will also have to push even harder for a greater role for the non-oil economy.

About the author: John Roberts is an international energy security expert, a senior partner with Methinks Ltd, a consultancy specialising in the inter-relationship between energy, economic development and politics and a senior fellow at the Atlantic Council, a Washington DC-based think tank.